Become a Partner

Already a partner ? Login

Become a Partner

Already a partner ? Login

Program

Partner Program Overview

Designed to deliver unparalleled customer value and accelerated mutual growth by harnessing partner expertise and ColorTokens cybersecurity technology.

Learn MoreInfrastructure

Quick Links

Case Study

Industry Solutions

Quick Links

Program

Designed to deliver unparalleled customer value and accelerated mutual growth by harnessing partner expertise and ColorTokens cybersecurity technology.

Learn MoreFeatured Topic

Newsletter

Cybercriminals view financial services companies as high-value targets due to their online operations and the extremely sensitive customer data they handle. Traditional reactive security measures based on perimeter protection and intrusion detection are no longer effective against today’s cyberattacks. To retain client trust and confidence, financial institutions must adopt a proactive security approach to be cyber resilient, stay agile, and manage risk.

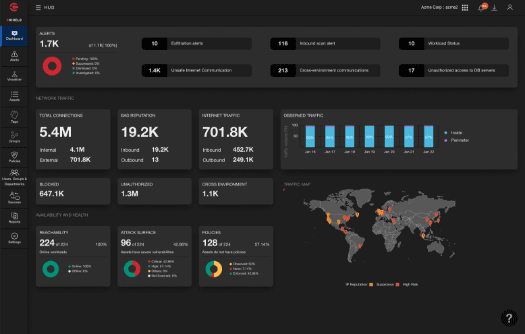

ColorTokens provides a unified and proactive zero trust approach that spans data, applications, workloads, and networks.

Visibility across the network allows for faster breach detection and containment, so ransomware, APTs, and insider threats are quickly blocked by lateral movement prevention.

Gartner® and Peer Insights™ are trademarks of Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Peer Insights content consists of the opinions of individual end users based on their own experiences, and should not be construed as statements of fact, nor do they represent the views of Gartner or its affiliates. Gartner does not endorse any vendor, product or service depicted in this content nor makes any warranties, expressed or implied, with respect to this content, about its accuracy or completeness, including any warranties of merchantability or fitness for a particular purpose..

Take ColorTokens Xshield for a test drive.

See HowA need for agile security to protect hybrid and multi-cloud environments, third-party integrations, and traditional on-premise services

Undetected insider attacks that lead to financial losses, regulatory fines, and brand reputation damage

Limited visibility across complex networks, unpatched legacy systems, and inadvertent misconfigurations

Multiple siloed security solutions that decrease operational efficiency

Constant pressure to reduce IT operational costs while strengthening the security posture

A growing number of compliance regulations that result in financial penalties if not met

Achieve a centralized view of authorized and unauthorized traffic across critical banking applications, servers, workloads, endpoints, and clouds in any multi-vendor data center environment. A web-based dashboard simplifies management, and reduces the need for multiple monitoring tools.

Prevent lateral movement with fully customizable lockdown capabilities. Transactional servers, endpoints, and ATM kiosks can be made tamper resistant to known and unknown threats by enabling process-level visibility, and permitting only the known-good (or whitelisted) processes to run.

Reduce the attack surface by isolating application environments, critical assets, and core banking servers. Software-defined micro-segmentation, based on a zero trust approach, allows access to these applications only if all trust parameters are met.

Meet regulatory compliance requirements — FINRA, GDPR, PCI-DSS, and others — and reduce costs. Gaining granular visibility across subnets and application segments limits the audit scope of data centers and eliminates the need to analyze every access control list.

Learn More

By submitting this form, you agree to ColorTokens

Terms of Service and

Privacy Policy